JUNE 10, 2024

Ito ang araw kung saan ay nagulat, kinabahan at natakot ang lahat dahil sa “Revocation Order” na inilabas ng Securities and Exchange Commission (SEC) sa kumpanyang SEATAOO o sa New Seataoo Corporation. Isa sa mga nakarating na reklamo sa SEC ay isa diumanong investment company ang Seataoo. Base sa mga nagpadala ng mga kanilang reklamo ay inisip ng SEC na ito daw ay gumagawa o nagpapatupad ng PONZI-like scheme na isa sa mga ipinagbabawal.

THE Securities and Exchange Commission (SEC) has revoked the registration of New Seataoo Corp. and Seataoo Information Technology OPC and imposed a P1-million fine for unauthorized investment activities. In a May 10 order, the agency’s Enforcement and Investor Protection Department (EIPD) said that Seataoo was soliciting investments from the public without the required license, in violation of the Securities Regulation Code (SRC). Seataoo, registered as two separate entities, was said to have advertised itself as a cross-border e-commerce platform offering a drop-shipping business model.

However, the SEC said that it was actually a Ponzi-like scheme where investors were promised profits primarily from the efforts of other people. The EIPD’s investigation revealed that the company’s operations involved elements of an investment contract, which required prior registration and approval from the commission.

The agency also said it had received numerous complaints against Seataoo since last year for requiring sellers to pay for products upfront, which were then marketed as investments rather than retail transactions. Despite a show cause order issued on March 22, 2024, Seataoo denied the allegations, claiming that its business operations were legitimate and its sellers were not investors.

The regulator concluded that the money paid by sellers comprised capital investments used in a common enterprise with the expectation of profits derived from Seataoo’s efforts. “Seataoo’s activities went beyond the powers conferred by its Articles of Incorporation and involved serious misrepresentation to the great prejudice of the investing public,” the SEC said in its order.

DEFINITION OF SEC TO INVESTMENT

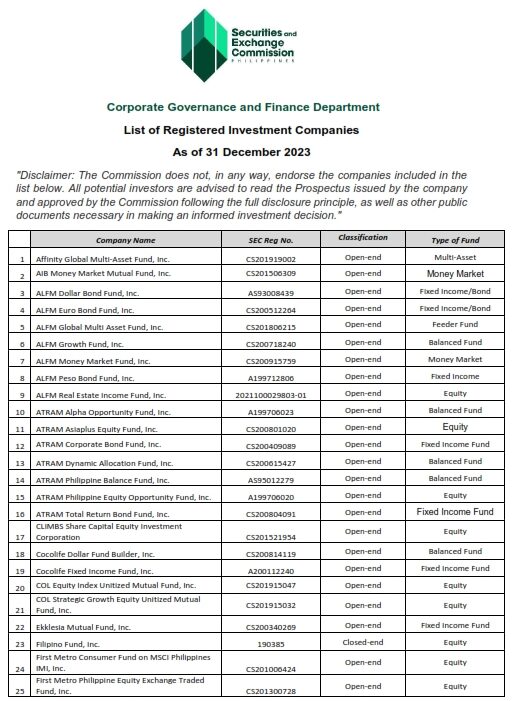

The Securities and Exchange Commission (SEC) of the Philippines doesn’t provide a general definition of “investment” itself. However, their focus lies in regulating investment companies and securities.

Here’s what we can glean from their perspective:

- Investment Company Definition: The SEC defines an investment company as any entity that primarily invests, reinvests, or trades in securities https://www.sec.gov.ph/investment-companies/list-of-registered-investment-companies/. This definition highlights the act of allocating resources towards securities with the expectation of earning profit.

Securities can include stocks, bonds, treasury bills, and other financial instruments.

While the SEC doesn’t offer a broad definition of investment, their focus on investment companies offers insight into how they view investments – as the allocation of resources towards securities for financial gain.

Investment companies, as mentioned in the attached PDF, generally work by pooling money from multiple investors to purchase a diversified portfolio of securities. These companies can be classified into different types, each with its own investment strategy and goals. Here are the key elements that define how these investment companies operate and are considered as investment companies:

- Pooling of Funds:

- Investment companies collect funds from individual investors. This pooled capital is then invested in a variety of securities such as stocks, bonds, money market instruments, and other assets.

- Diversification:

- By pooling funds, investment companies can achieve diversification, spreading investments across various assets to reduce risk. This is particularly advantageous for individual investors who might not have enough capital to achieve such diversification on their own.

- Professional Management:

- These funds are managed by professional portfolio managers who make investment decisions based on research, market conditions, and the fund’s investment objectives.

- Types of Investment Companies:

- Open-end Funds: Also known as mutual funds, these do not have a fixed number of shares. They issue and redeem shares at the fund’s net asset value (NAV) based on the current market value of the fund’s assets.

- Closed-end Funds: These funds issue a fixed number of shares and are traded on stock exchanges. Their price can vary from the NAV based on supply and demand.

- Unit Investment Trusts (UITs): These hold a fixed portfolio of securities and have a set end date.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges like closed-end funds.

- Regulation and Compliance:

- Investment companies are regulated to ensure transparency, protect investors, and maintain fair market practices. They must comply with the Securities Regulation Code and other relevant regulations.

- Types of Funds:

- Equity Funds: Invest primarily in stocks.

- Fixed Income/Bond Funds: Invest in bonds and other debt instruments.

- Balanced Funds: Invest in a mix of equities and bonds.

- Money Market Funds: Invest in short-term, high-quality investments issued by government and corporate entities.

- Feeder Funds: Invest in shares of another mutual fund.

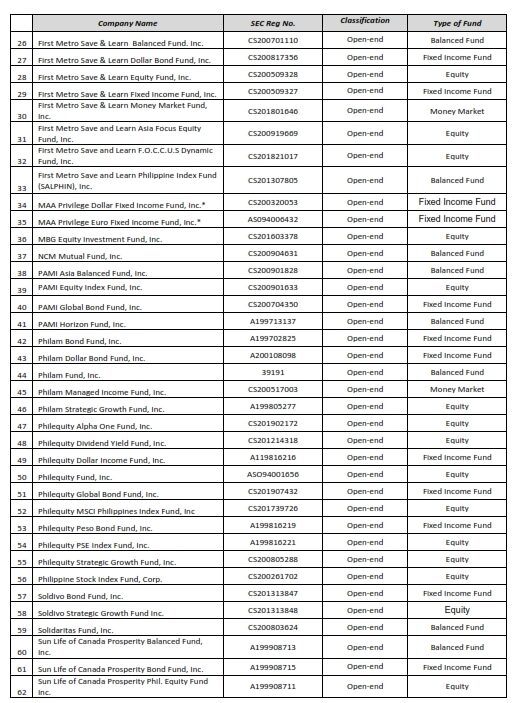

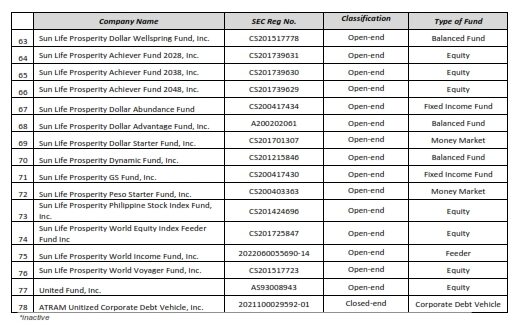

Here are some examples from the attached document:

- Affinity Global Multi-Asset Fund, Inc.: An open-end multi-asset fund that invests in a diverse range of assets to balance risk and return.

- AIB Money Market Mutual Fund, Inc.: An open-end money market fund focused on short-term debt instruments.

- ALFM Dollar Bond Fund, Inc.: An open-end fixed income/bond fund investing in dollar-denominated bonds.

- ATRAM Alpha Opportunity Fund, Inc.: An open-end balanced fund investing in both equities and fixed income securities.

Each fund listed operates under the principles of pooling investor money, professional management, diversification, and adherence to regulatory standards, ensuring they meet the criteria of being investment companies.

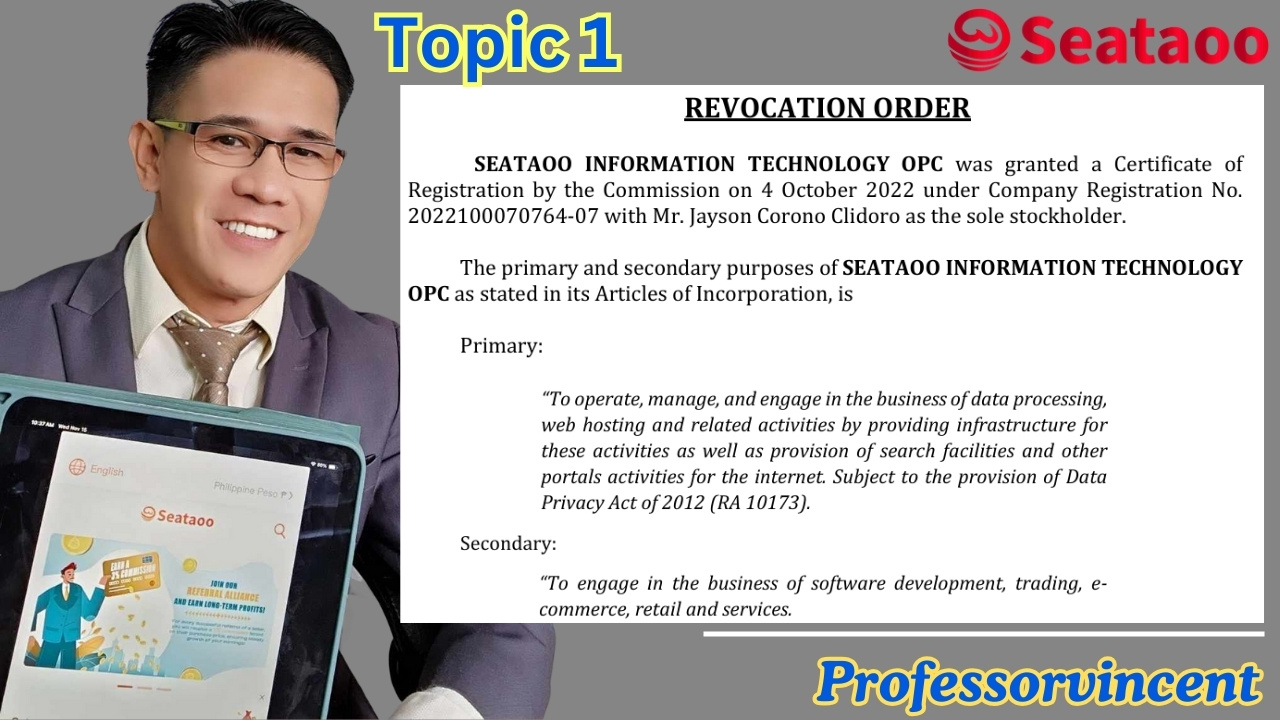

LETS DISCUSS THE CONTENT OF THE REVOCATION ORDER

The primary and secondary purposes of SEATAOO INFORMATION TECHNOLOGY OPC as stated in its Articles of Incorporation, is

Primary:

“To operate, manage, and engage in the business of data processing, web hosting and related activities by providing infrastructure for these activities as well as provision of search facilities and other portals activities for the internet. Subject to the provision of Data Privacy Act of 2012 (RA 10173).

Secondary:

“To engage in the business of software development, trading, e- commerce, retail and services.

The primary purpose of NEW SEATAOO CORPORATION as stated in its Articles of

Incorporation, is

“The company will engage in e-commerce retail business”

As advertised on social media (Facebook, Youtube), NEW SEATAOO CORPORATION and SEATAOO INFORMATION TECHNOLOGY OPC “collectively herein SEATAOO” is a cross-border e-commerce that features a “Dropshipping Platform” and provides a seamless and secure online shopping experience to customers worldwide. SEATAOO offers its services by accommodating sellers to have their own shop by using Seataoo’s platform of Application where a seller can manage and monitor his/her own shop.

In the month of April 2023, the Commission began receiving inquiries and information from the public that individuals or group of persons representing an entity named “SEATAOO” was soliciting and/or collecting money from the public in the form of investments.

NA-SCAM KA BA NG SEATAOO?

Ito na ang pagkakataon ng maraming nag-aakusa upang ikwento kung paano sila na Scammed at bakit nila sinabing Investment ang Seataoo. This Article is your opportunity to voice out and reveal the truth.

New Seataoo Corporation, a company recently scrutinized and penalized by regulatory authorities, has been labeled an investment company due to its operational practices. Despite its formal classification as an information technology and e-commerce business, the company allegedly engaged in activities characteristic of investment scams. Complainants are encouraged to share their experiences and provide evidence to substantiate their claims. Below are three illustrative paragraphs based on hypothetical scenarios inspired by common issues in similar cases:

Paragraph 1: Investor Recruitment and Promised Returns

Several complainants have reported that New Seataoo Corporation lured them into investing substantial amounts of money with promises of high returns. The company portrayed itself as a legitimate business offering investment opportunities through a sophisticated online platform. Investors were told they could earn significant profits by participating in what was described as a “dropshipping platform” that required initial capital. The promise of easy and lucrative returns enticed many individuals to part with their savings, expecting the returns to be managed and disbursed by the company.

Paragraph 2: Lack of Transparency and Misrepresentation

As time passed, investors began noticing discrepancies between the promised returns and the actual profits they received. Many reported that the company provided little to no transparency regarding how their money was being utilized or the specific operations generating the promised returns. Attempts to access detailed reports or contact customer service were often met with vague responses or complete silence. The initial excitement and trust turned into suspicion and frustration as investors realized that the company’s communications were filled with misrepresentations and that the business model was not as robust or legitimate as initially portrayed.

Paragraph 3: Evidence of Financial Irregularities and Legal Action

Complainants have shared various forms of evidence indicating that New Seataoo Corporation engaged in financial irregularities. Bank statements, transaction records, and email correspondences reveal a pattern of delayed payments, unfulfilled promises, and outright refusal to return invested capital. Some investors provided screenshots of the company’s online platform showing manipulated investment figures and fictitious buyer transactions. These pieces of evidence have formed the basis of multiple complaints to regulatory bodies, culminating in the company’s classification as an investment company operating without proper authorization and engaging in fraudulent activities. The complainants call for justice, hoping that their stories will prevent others from falling victim to similar schemes and that regulatory actions will hold the company accountable.

These paragraphs aim to encapsulate the types of stories and evidence that complainants might present to demonstrate how they were scammed by New Seataoo Corporation and why it is viewed as an investment company.

Seataoo is like Amazon for me..thesame concept of business ..i will stand strong..

gud evening,nag start po ako maging seller ni seataoo noong January 12 2024,ngaun po ay 6months na akong seller.wala naman po akong na experience na kakaiba sa platform mg seataoo.napaka smooth po ng transaction,wallet recharge man o widrawal.shopee at lazada seller din po ako,kya mejo may alam ako s dropshipping.my,dropshipping din po akong sinalihan dati pero may mothly subscription po.sa observation ko nga po,mas madali pang pumasok ang widrawals ko sa seataoo kesa s shopee at lazada,pg na request po ako ng monday ng widrawal sa shopee Wednesday or Thursday pa ang pasok s aking bank,pero dito po sa seataoo,pg nag request ka ng umaga sa hapon po ay nasa bank mo na,kaya napakaling tulong po etong dropshipping na ito sa amin.naniniwala po ako na sa mga darating pang buwan ay lalong gaganda ang seataoo.marami po kaung natutulungan na mga sellers,salamat po

Am proud Seataoo Seller since December 2023 it’s been 6momths na po. Thankful po kami dahil sa seataoo flat form kumikita kami para may pang bayad sa bills at pang bili Ng gatas at daiper. SI seataoo ay Isang e-commerce dropped shipping.

I would like to express my own perspective on this matter. First of all being a seller in just almost four months, I have experienced glitches dun sa website ni Seataoo but it did not require major attention dahil nga puro minor lang naman. Gaya ng sabi ni Prof Vincent which I personally know nga pala, magkakaroon ng mga ganitong event gaya ng delay sa withdrawal, delay ng pagbalik ng pera sa wallet, delay ng pagtanggap ng orders ng mga buyers, which is normal sa mga ganitong platforms. Hindi naman sila nagkukulang na sagutin tayo in the case na may mga katanungan at hinaing sa store natin. Nagsimula lang din ako sa maliit na kapital pero dahil nagagampanan ko naman ng maayos ang pagiging seller ko maayos din naman ang nagiging takbo ng store ko. Hindi naman sa pagmamalaki, kahit wala akong affiliate kumikita po ang store ko. OFW po ako hindi man ganun kalaki ang kita ko sa store ngayon atleast nakakatulong pa rin gaya ng pambayad sa bills. Noon akala ko Fonzi scheme pero nung nasubukan ko na nagkamali pala ako. Kung sabay nga lang kami ni Prof Vincent na nagsimula nun malamang mas malaki na kinikita ko ngayon. Tayo po ang nagpa process ng sarili nating store at dun po tayo kumikita hindi po si Seataoo ang gagawa nun para sa atin, at dahil dyan I’m proud to be one of the legit sellers. Maraming salamat!

Napakalaki ng tulong ng SEATAOO sa aming mga OFW. Naka 12 times na ako nagwidro at walang naging problema. Ito ang magiging tulay ko para mag for good na sa Pilipinas at makasama ko na pamilya ko. Ilang beses na rin ako na scam online ang tinatagal lang ay 1 month tpos nawawala ng parang bula ang company. Pero ang SEATAOO ay magdadalawang taon na at ako ay 8 months seller na. Sobrang laking tulong nito samin. Sana naman maging patas ang SEC sa desisyon nila. Kalimitang nagrereklamo ay iyong mga taong pinasok ang business ng walang alam at kapag hindi naintindihan reklamo agad sa social media which is very unfair saming ibang mga seller na tahimik na kumikita. Walang kinukuhang pera samin ang SEATAOO bagkus bumabalik lahat ang kita namin. Sana SEC pakinggan ninyo kaming mga legit seller at wag kayong maging bias. Maraming maapektuhan mga seller kapag natuloy ang revocation sa SEATAOO. Napakalaking tulong nito sa aming mga OFW. Intindihin mabuti ang comment naming mga silent seller. Iyong mga nagrereklamo ay karamihang hindi naman seller pero kaming mga legit seller ay wala naman reklamo. Please lang SEC aralin ninuong mabuti at sana pakinggan ninyo ang aming hinaing.

Mas gusto c seataoo kumpara sa ibang flatform, nag simula ako sa maliit na puhunan hanggang sa med u lumaki na ito at nkapag widraw din ako sa amount na gusto ko, kay seataoo ko lang naransan ang ganitong drop shipping na gamit lang ang computer or cp, isa po akong ofw na nsa saudi arabia at nkapag transuction smoothly araw araw kay seataoo

Gusto ko ibahagi ang karanasan ko kay Seataoo kasi nuong una akala ko din talaga scam ito. Pero bakit ko nga ba huhusgahan kung hindi ko pa naman nasusubukan? Kaya naman nanuod ako ng sandamakmak na videos sa Youtube about sa Seataoo. Siyempre madami ako napanuod na ang sabi ay scam ito, pero dahil wala naman napakitang concrete evidences yung mga gumawa ng videos na yun, mas pinili ko maniwala dun sa mga napanuod ko na nag pakita ng business permit, SEC registration at BIR registration ni Seataoo. Pati yung mga nag gawa ng vlogs sa office tour and warehouse tour ni Seataoo. Nuong naging seller na ako at nakapag lagay na ako ng capital, patuloy pa rin ako sa research ko about kay Seataoo. Siyempre di naman maiiwasan yun kasi kabado pa rin ako baka bigla nalang mawala pera ko. Hanggang sa madami na ako na benta na items at nakikita ko na tumutubo na yung capital ko. Malaking tulong sakin yung naging unang profit ko kay Seataoo kasi napambayad ko siya ng bills namin sa tubig at kuryente. Kaya ginawa ko dinagdagan ko yung capital ko para mas madami pa ako ma proseso na orders at mas malaki yung maging profit ko, ang goal ko that time is pati yung budget namin pang groceries sa profit ko na kay Seataoo kukuhanin. Sa patuloy kong pag research, may mga bagay akong na realize. Gusto ko ibahagi yung tatlong pinaka importante. Una, hindi dapat pinapasok ang isang negosyo kung hindi mo ito naiintindihan. Lahat kasi ng nakikita kong nag sasaad ng mga negative comments kay Seataoo, sila yung mga hindi nakakaintindi kung paano ba yung proseso ng isang dropshipping business. Sa totoo lang katulad lang din ng traditional dropshipping business si Seataoo, ang pinagkaiba lamang nila is pinagsama na nila sa iisang platform lahat, ito yung tinatawag natin na innovation, na hindi ko malaman bakit sarado ang utak ng karamihan sa ganito. Pangalawa, yung mga nag sasabi na scam si Seataoo kahit kailan wala po sila napatunayan na may na scam. Kahit isang pangalan po or username nung na scam wala talaga. Duon ako talaga napaisip na bakit ako mag papaapekto sa mga sinasabi nito, wala naman sila maipakita. Kaya hindi dapat tayo naniniwala sa puro hearsay lang. Pangatlo, meron bang scammer na may physical office at warehouse na anytime pwede bisitahin? Bakit yung mga gumagawa ng videos na nag sasabing scam si Seataoo never bumisita sa office at warehouse nila? May scammers bang nagpapakita ng muka sa publiko araw-araw at pinapaalam yung buong pangalan nila? Bakit yung mga gumagawa ng negatibong videos about Seataoo sila pa yung nagtatago ng identity nila? Meron naka suot ng face mask sa video, meron faceless videos talaga, at marami yung gumagamit lang ng dummy accounts. Gusto ko lang iparating na buo ang loob ko kay Seataoo kasi naranasan ko maging seller. Never ako hiningian ni Seataoo ng pera para e invest sa securities. Ako mismo ang nag lagay ng pera ko sa platform ni Seataoo. Yun ang capital ko na ginagamit ko pang proseso ng mga orders para tumubo ako sa mga nabebenta kong mga produkto sa store ko. Nakikita ko rin po ang store ko. Nakikita ko rin ang store ng ibang sellers. Aaminin ko hindi pa ganuon kaganda yung website ni Seataoo, meron pang mga errors at glitches. Pero nakikita ko po yung mga stores. Napaka dami po, may list yan pwede ninyo tignan sa mismong website nila. Natutuwa rin ako dahil patuloy yung improvement na ginagawa ni Seataoo sa kanilang website at app. Napaka bilis din nila lapitan kapag may nagiging problema halimbawa na lamang nagkaroon ng delay sa withdrawal. Naaayos po palagi. Panalangin ko lamang sana malagpasan ni Seataoo yung hinaharap nila ngayon na problema. Bilang isang seller ni Seataoo, ibibigay ko ng buo yung suporta ko.

As Seatao seller for 7 months has no experience receiving email from them about investment. I earned profit by processing orders received thru Seataoo online platform; if I failed to process orders on a day I can’t earned profit. Also, I already withdraw almost of my capital and only the profit remained in my account which I used to process orders.

Dear Professor Vincent..

ako ay new seller dapat kasi last year pa ako nag umpisa dito sa seatoo pero yong code na ginagamit hindi na nagtagal sa seataoo umalis na siya hindi ko na lng banggitin nakaraan na yon pero hnd naman ako nag lagay ng pera doon pero nagpasalamat ako hnd ako natuloy na sya ang maging mentor ko…bka mahirapan pa ako…pero nakita kita sir at na gustohan ang pagiging mabusisi mu sa mga legality ng seataoo at kung anu bavtalaga ang seataoo kc sko ofw dito sa macau limited lng din oras ko para mag research..cympre galing work pagod na 12 hours duty minsan 13 hours pa..kaya ako nag decide sumali ngayon kc gusto nang mag for good next year at makasama ang mga mahal sa buhay..13years na akong nag abroad wala nman nangyare hirap pa din.. nagustuhan ko dito kasi talagang mag karoon ka ing income dito kung baga pwd stepping stone para maka pag for good at hnd kana mag alala pa sa mga gastosin sa pang araw araw ang ipon hnd na magagalaw…sana bigyan nman nila ng pagkakataon ang mga Filipino na tulad ko…malaki nman contribution nito sa atin mga filipino…yon lng poh at salamat sa email mo Prof Vincent..

For seataoo laban lang tayo..

Sa dinami dami kung pinasukan negosyo online. Ang Seataoo lamang ang nagbigay ng breakthrough sa hinahanap kong concepts. Habang nagtatrabaho ako nagagawa kong isingit ang negosyo ko. Kaking tulong ito hndi lamang sa akin maging sa aking pamilya. Bilang isang panganay n anak nakapagdagdag ito nang kagaanan sa lahat ng aming pangangailangan. Hindi po ito scam bagkus tulong ito sa lahat para matutung mgnegosyo. Nasa digital world na tayo kaya sana naman po. Nagbigay na ngtulong sa mga Pilipino ganito pa ang paratang sa kanila. Sa lahat na naging bahagi ng mganda ginawa ng seataoo feel ko ang dis appointment ninyo. Ganun din ako bilang manggagawa na natulungan ng seataoo.

I don’t think it’s an investment fraud. Because the capital needed to complete orders will result in a profit, and if you do not process the orders, your money will simply sit in your wallet and you will not make any profit at all. You can still take the money out at any time.

Good morning po, 10 months na po ako sa seataoo, sa dami po ng online business na pinasukan ko kay seataoo lang ako kampanti 2k lang po talaga ang unang capital na nilagay ko 100+ lang ang price ng product na kaya ko hanggang ng dagdag ako kunti kunti na monitor ko sya araw araw. Pag gising ko palang seataoo na agad check kung nadeliver na ba, may bumalik na ba sa wallet hanggang ngayon. My dad is 90yrs old and my mom is 87 lahat ng expeses nila sa seataoo lang nanggagaling diaper gamot gatas. Kung salary lang aasahan ko hindi ko kaya lahat yan. Si seataoo ang naging inspiration ko para mangarap pa sa buhay.

Good morning po, 10 months na po ako sa seataoo, sa dami po ng online business na pinasukan ko kay seataoo lang ako kampanti 2k lang po talaga ang unang capital na nilagay ko 100+ lang ang price ng product na kaya ko hanggang ng dagdag ako kunti kunti na monitor ko sya araw araw. Pag gising ko palang seataoo na agad check kung nadeliver na ba, may bumalik na ba sa wallet hanggang ngayon. My dad is 90yrs old and my mom is 87 lahat ng expeses nila sa seataoo lang nanggagaling diaper gamot gatas. Kung salary lang aasahan ko hindi ko kaya lahat yan. Si seataoo ang naging inspiration ko para mangarap pa sa buhay.

Hello po. 1 month pa lang po ako sa dropshipping na ito pero masasabi ko po na ito ang pinakamaganda at pinakamadaling dropshipping na sinalihan ko.. hindi ko na po kailangan mag post pa ng product sa social media o mag live para may bumili sa item ko. Di po katulad dito sa Seataoo ang gagawin ko lamang po ay mag process sa mga order na pumapasok. Napakalaking tulong po nito bilang housewife po at sa bahay lamang ako kasama ng aking ay nagagawa ko po ito ng maayos at napakalaking tulong po nito sa aming mga ordinaryong mamamayan. At sa loob po ng 1month ay nasubukan ko na din pong mag withdraw. Kaya hindi po ito scam dahil marami pong mga Pilipino na natulungan si Seataoo.. sa mga kapwa ko seller laban lang po. God is with Us🙏🏻. Godbless po sa lahat🙏🏻

Napakalaking tulong ng seataoo personaly sa tulad ko na matagal ng nghahsnap ng business na swak sa oras ko. Kumuta nadin ako at nkoag ROI na . Hindi katulad ng ina na nasubukan ko na walang napala wala ding kinita . Seataoo is helping alot of filipino kahit saan mang lugar . Go seataoo!

Naging seller ako since September 2023, malaking tulong ito sa aking bilang ofw, halos katumbas na ng sahod ko ang kinikita ko as a seller Kay Seataoo, kaya nag decide na ako na mag for good dito sa Pilipinas, since na naging seller ako, Wala pa ako na encounter na issue, sa pag process at pag withdraw, napaka smooth na platform na ito, sa ngayon nandito na ako sa Pinas, hoping na tuloy tuloy Ang magandang Kita Kay Seataoo upang madami pang mga ofw Ang matulongang makapag for good na tulad ko.

Good day,

I’m so happy ng makilala ko ang seataoo ang ganda ng business at madami natutulungan lalo na samin mga ofw malaking help ang seataoo bumabalik talaga capital at profit pag delivered na product sa customer. Sana tumatag at tumagal pa ang seataoo para mas marrami pang matulungan pinagpipray namin ng family ko kasi malaking tulong sa lahat.

Im a new seller from Seataoo.I started January 2024. Before this ng try nko sa ibang dropshipping company, pero ng quit din ako kc my certain amount kang iddeposit bago mkapagstart ,mahirap intindihin ung flow ng company nila at poor ung support from management din. Hanggat nkita ko c Seataoo sa youtube. Umpisa ng alangan ako kaya sinubukan ko muna sa maliit na halaga. i was suprised na super SMOOTH ng transaction sa Seataoo. Madaling intindihin ang bussiness.Kahit sa maliit na halaga pwede ng mg umpisang mg negosyo na WALAng membership. aside from that MONITORED ko lht ng ngyyari sa pinuhunan ko ,kung kelan babalik at magkano ang EXACT amount..Hindi ako nangangamba kung saan nppunta ung pera ko WALANG nawawala,KUMIKITA pa nga. Sa withrawal hussle free din. .. Aside from that napaka SUPPORTIVE and ACCOMODATING ng Seataoo team sa mga inquiries and help kung kinakailangan.. Kaya sa SEC sana busisiin nila maiigi at huwag maniwala sa mga taong Hindi nmn totoong Seataoo seller na pawang naninira lamang sa business. Maraming natutulungan ang Seataoo at nabibigyan ng Pag Asa para umunlad. Keep strong Seataoo . I’ll Trust you and will stand beside you.

I’m proud to be a SELLER of Seataoo Nagkaroon Ako ng Extra Income at nagakaroon ng Financial Freedom , nakapalaking tulong ni SEATAOO sa mga nagtiwala sa Flatform na ito ni SEATAOO ♥️, Ang masasabi ko lng maraming Salamat sa big opportunity na binigay mo sa aming mga Seller, Walang mapaglagyan ng tuwa Namin ng dumating ka sa Buhay Namin,,, 🥰♥️🫰,,

I hope na malagpasan mo itong pagsubok na dumating, dahil sa paninira iba para bumagsak,,,

Kasama ka sa aming

mga Prayer🙏🌹♥️

Naniniwala kami na maging okay din Ang lahat ng ito,””

God is Good”

all the Time ♥️🌹🫰

God Bless Us All ♥️♥️💞

Simula pa noong pandemic ay kung anu-ano ng pagkakakitaan ang sinubukan ko, nagtinda ako ng bagoong, tuyo, kasangkapan, damit at marami pang iba. Iba’t-ibang online selling platform na din ang tinry ko, local and international, hindi ko na iisa-isahin. Ang hirap kasi, ang hirap magtinda, yung struggle ng isang seller is real, kulang na lang magmakaawa ka sa mga tao para lang may bumili ng product o ng tinda mo. Ang masakit pa kahit kapamilya o mga kaibigan ang hirap kumuha ng support sa kanila. Hanggang nag try ako ng dropshipping business, kahit may subscription fee, sige go ako, baka sakali ito na yung hinihintay ko, dahil walang hawak na products siguro madali na magbenta. Pero wala pa din, walang orders kung wala kang maraming effort na gagawin, hindi rin sapat ang kita, hindi makakabuhay ng pamilya. Kung gusto mo naman ng maraming orders, kailangan mong mag promote, post dito, post doon sa mga social media platforms, para mapansin ang product mo, need mo din mag ads, or sumali sa mga campaign, pero wala din, ang ending, ang liit na nga ng kinita mo, dami pang deductions dahil sa campaigns.😔 Minsan maiiyak na lang ako at magdarasal…humiling ako kay Lord na sana bigyan Niya ako ng online business na magkakaroon talaga ako ng stable income, pra naman matulungan ko si hubby sa mga gastusin namin. Nangarap ako, at sinabi ko sa sarili ko, darating din ang araw na hindi na ako mahihirapan magbenta, hindi nako makikiusap pa sa mga tao pra lang bumili sila. Halos sumuko na ko sa dami ng online opportunities na nasubukan ko, sinabi ko sa sarili ko, ayoko na, hindi yta para sa akin ang pag oonline. Until one day, sumubok pa din ako, sabi ko last na ‘to, hanap ulit ako ng online business na pwede ko ulit subukan, online kasi yun lang ang kaya ko, mahiyain ako, at isa pa wala akong alam sa mga traditional businesses. Hanggang sa napanood ko si Prof. Vincent sa isang vlog niya about Seataoo, umpisa pa lang naengganyo nako, nakaka inspire si Prof. sa mga narating niya. Buong araw ako nag search ng iba’t-ibang vlog about Seataoo, nag legit check din ako sa mga online universities. Sabi ko sa sarili ko, this is it!…ito na ang sagot sa aking mga dasal, kaya join agad ako kinabukasan bilang seller. Professor Vincent guided me, then may free webinar pa si Coach Jimmy kaya umpisa pa lang naging smooth na ang journey ko as a Seataoo seller, kung meron mang mga challenges very minimal lang at madali lang matutunan, dahil gusto ko ang negosyo kaya inaral kong mabuti. Tuwang tuwa ako kasi kahit magkano lang capital ko ay pwede nako mag start, tapos hindi na kailangan mag promote ng products, Yeheyy! may business na ako! Sobrang saya ko😍😍 dahil finally dumating na yung business na pinapangarap ko lang dati, hindi nako mahihirapan magbenta, hindi nako makikiusap sa mga tao na bumili ng products, dahil sa Seataoo, spoiled ang mga sellers, walang kahirap-hirap, sila na ang bahala sa lahat, literal na hassle-free dropshipping, daming orders, pick ka lang ng orders to process, every picked-up there’s a profit, ang saya! Kumikita ako kahit nasa bahay lang, hindi ako napapagod, ang daming oras sa family. I must say, Seataoo is truly a very unique Dropshipping platform, may malasakit talaga sa mga Pilipino, na kahit sino, simpleng tao ka man o professional, may experience ka man sa negosyo o wala, ay pwede kang maging seller dito. Katulad ko na simpleng maybahay at may dalawang anak, nangarap na magkaroon ng sariling business, ngayon, isa na akong Entrepreneur sabi ng husband ko, na sobrang proud sakin dahil sa hinaba haba ng paghihintay dumating din ang “Dream Business” namin na matagal na naming inaasam. Naiinggit nga sya sakin dahil kumikita daw ako ng stress-free, hindi katulad niya ang daming stress sa work, kaya sabi ko sa kanya, konting tiis na lang, konting kembot na lang, by God’s grace🙏 pwede ka ng mag resign at mag focus na lang tayo sa Seataoo😃😍. Nakakapag provide nako hindi lang sa mga needs ng mga anak ko, pati mga wants nila ay nabibigay ko na rin, at syempre nakakatulong na ako kay hubby sa mga bills ang payables, anytime mangailangan may makukuhanan ako, seemless ang mga withdrawal transactions. Thank you Seataoo!❤️❤️❤️ Long Live Seataoo! Sana marami pa kayong matulungan na mga Pilipino lalo na mga OFW, na gusto no makauwi ng bansa para makasama na ang mga pamilya nila. I am Happy, Proud and Blessed Seataoo Seller for 5 months and counting 🙂 Thank you Lord God for this wonderful business that you have given to us🙏🙏🙏